Describe the Uses and Sources of Cash

Learn vocabulary terms and more with flashcards games and other study tools. Each ofthese uses of cash is examined below.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities

Assets are typically a source of cash as they can be sold to gain cash and liabilities are uses of cash as they turn into an expense down the line either paying accrued expenses or long-term liabilities.

. A firms activity in which cash is spent. Cash flow statement is not a substitute of income statement ie a profit and loss account and a balance sheet. Companies use cash to repay creditorsfrom whom they borrowed cash pay owners for their investments pay for costsinvolved in management operations and to acquire other resources.

It should be understood that it is the declaration of dividend rather than the payment of the dividend which is the use of funds. The procedure for preparing a cash flow statement is different from the. Sources of Cash Flow Statements.

These three sources of business cash flow can have a major effect on the growth and strength of your company. Plant and Machines Land and Building Furniture and Fittings etc is the outflow or application or uses of cash whereas disposing-off the fixed. One of the main uses of cash in this category then includes paying back the principal on those loans.

The other is paying distributions or draws to owners. The statement of sources and uses of funds tells us exactly where a company has generated its money from and how it was spent or put to use. Broadly speaking - sources of cash are things that yield cash and uses of cash drain the cash balance.

Purchased 23452 worth of office supplies on credit. Sources and uses of funds. An increase in a left-side asset account or a decrease in a right-side liability or equity account is a use of cash.

It provides additional information and explains the reasons for changes in cash and cash equivalents derived from financial statements at two points of time. Uses of cash-Increase in accounts receivable-Increase in inventory-Decrease in notes payable-Decrease in long-term debt. Name and describe four commonly used sources of short-term financing.

Paying for borrowed cash. Classify each transaction according to its serving as a source of cash to the firm cash inflow or a use of cash cash outflow. Cash comprises currency coins petty cash Petty Cash Petty cash means the small amount that is allocated for the purpose of day to day operations.

Factoring firms can also obtain short-term financing by using the services of a factor. The cash inflows into the company or the cash received and the cash outflows from the company or the cash spent are shown in this statement. A firm uses cash by either BUYING ASSETS OR MAKING PAYMENTS.

If assets decrease from last month to this month that is a source of cash. It is unreasonable to issue a check for such small expenses and for managing the same custodians are appointed by the company. The Sources and Uses of Funds Statement Beginning quantities of supplies equipment and furniture Purchase of building and land Initial startup costs for rent deposits for rent initial payments for insurance etc.

For example you may be providing furniture for your office getting a loan to purchase equipment or getting a line of credit for working capital. The following are the uses of working capital. The sources and uses of cash statement provides a way to gauge the performance of a business against industry averages for similar companies or against key competitors.

Operations financing and investments. Situation Source Use Last month Collins Construction Co. In the above Balance Sheet C6 is 2010s Cash.

Let us take a closer look at the sources and the uses of funds. Cash represents 6 percent of bank assets. Uses of Working Capital.

Understanding these 3 categories and how each is either providing or taking cash from your account will help you make sense of why your checking account is going up or down. The statement of sources and uses of funds also shows us how changes in. The Sources and the Uses.

If liabilities or equity grow from last month to. Business owners cant very well manage what they cant measure. Declaration of Cash dividend.

Companies borrow cash primarily through short-term bank loans and by issuing long-term notes and bonds. Start studying Sources vs. For example assume that on June 16 a company borrows 12000.

Each of these sources of cash is examined below. The payment to creditors for borrowed cash is one common waythat companies use cash. The opposite calculation applies for liabilities and equity.

Essentially I need my cash flow to do this. The declaration of cash dividend results in a current liability dividend payable and is therefore a use of funds. Companies obtain cash through borrowing owners investments management operations and by converting other resources.

Cash is generated from the investment in fixed assets and a firm earns profit accordingly from such investment of fixed assets through the operating activities of the organization in various forms or other acquisitions of fixed asset ie. A sources and uses of funds statement often referred to as a flow of funds report provides a mechanism for reporting how a farms performance during an accounting period influenced and was influenced by major funding activities. Read more checking account Checking Account A checking account is a bank account that allows multiple.

The sources of funds is where all the money for funding is going to come from. Spontaneous Sources of Funds certain sources of funding arise naturally during the normal course of business operations. 6302011 auto pull Income Statement D6 auto pull Income Statement D7 auto pull Income Statemetn D8 find difference between Balance Sheet C6 and D6 if an asset an increase is a use a decrease is a source.

Cash and due from balances at institutions Currency. The boxes below describe two examples of these activities. 2 Chapter Objectives Describe the most common sources of funds for commercial banks Describe the most common uses of funds for commercial banks Describe typical off-balance sheet activities for commercial banks.

Bankers analysts and investors use this information to evaluate the health of a business and identify above-average or below-average performers. Other working capital needs. Short-Term Bank Loans they are usually due in 30 to 90 days.

This report also reconciles information in the income statement the balance sheet and the cash flow statement. Better cash-flow management begins with measuring business cash flow by looking at three major sources of cash. If assets grow from last month to this month that is a use of cash.

Learn About Format Of Statement Of Cash Flows Chegg Com

Sources And Uses Of Funds Statement Aka Cash Flow Statement

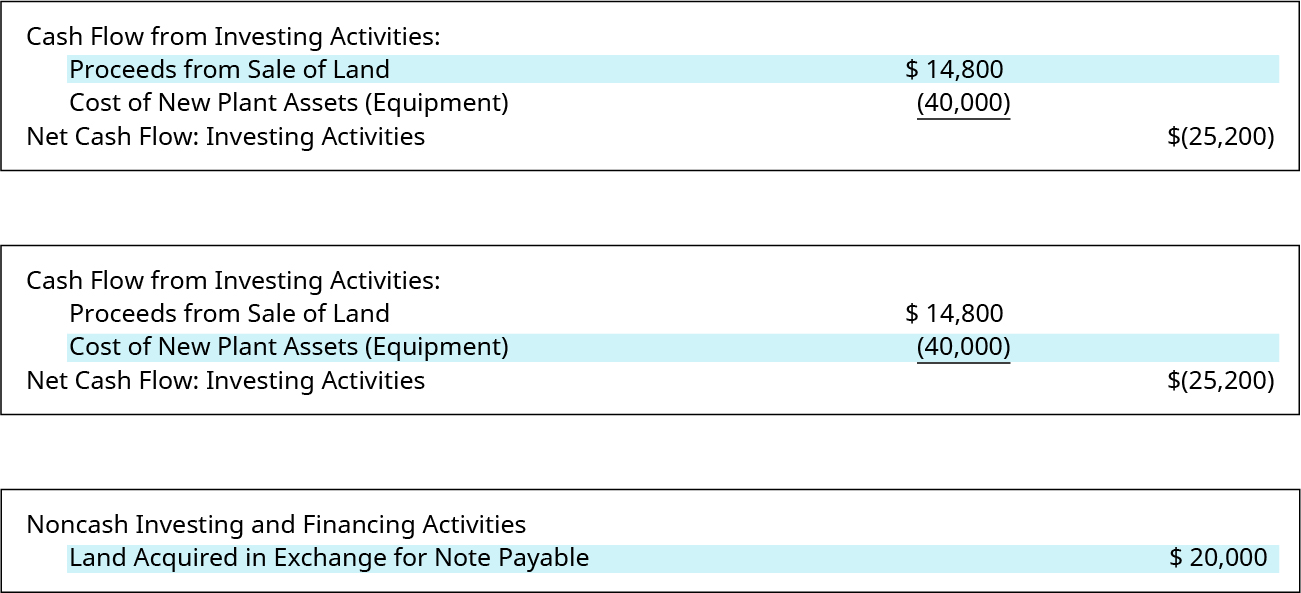

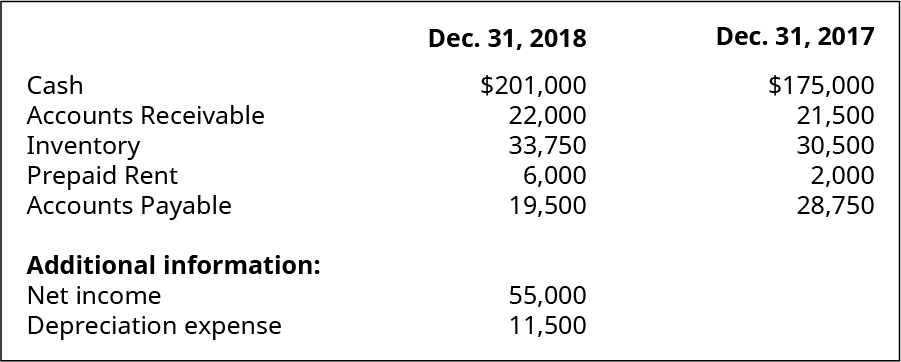

Prepare The Statement Of Cash Flows Using The Indirect Method Principles Of Accounting Volume 1 Financial Accounting

Illustration Shows How Windows With Low E Coatings Reflect Back Part Of Your Room S Heat In The Energy Efficient Windows Energy Saver Vinyl Replacement Windows

Tops Money And Rent Receipt Books 2 3 4 X 4 7 8 2 Part Carbonless 50 Sets Book 46820 In 2022 Receipt Template Receipt Book Printing Services

Acc1 14 The Statement Of Cash Flows 2 Flashcards Quizlet

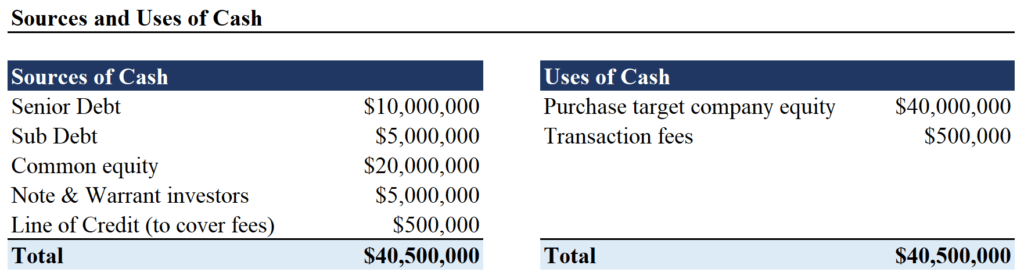

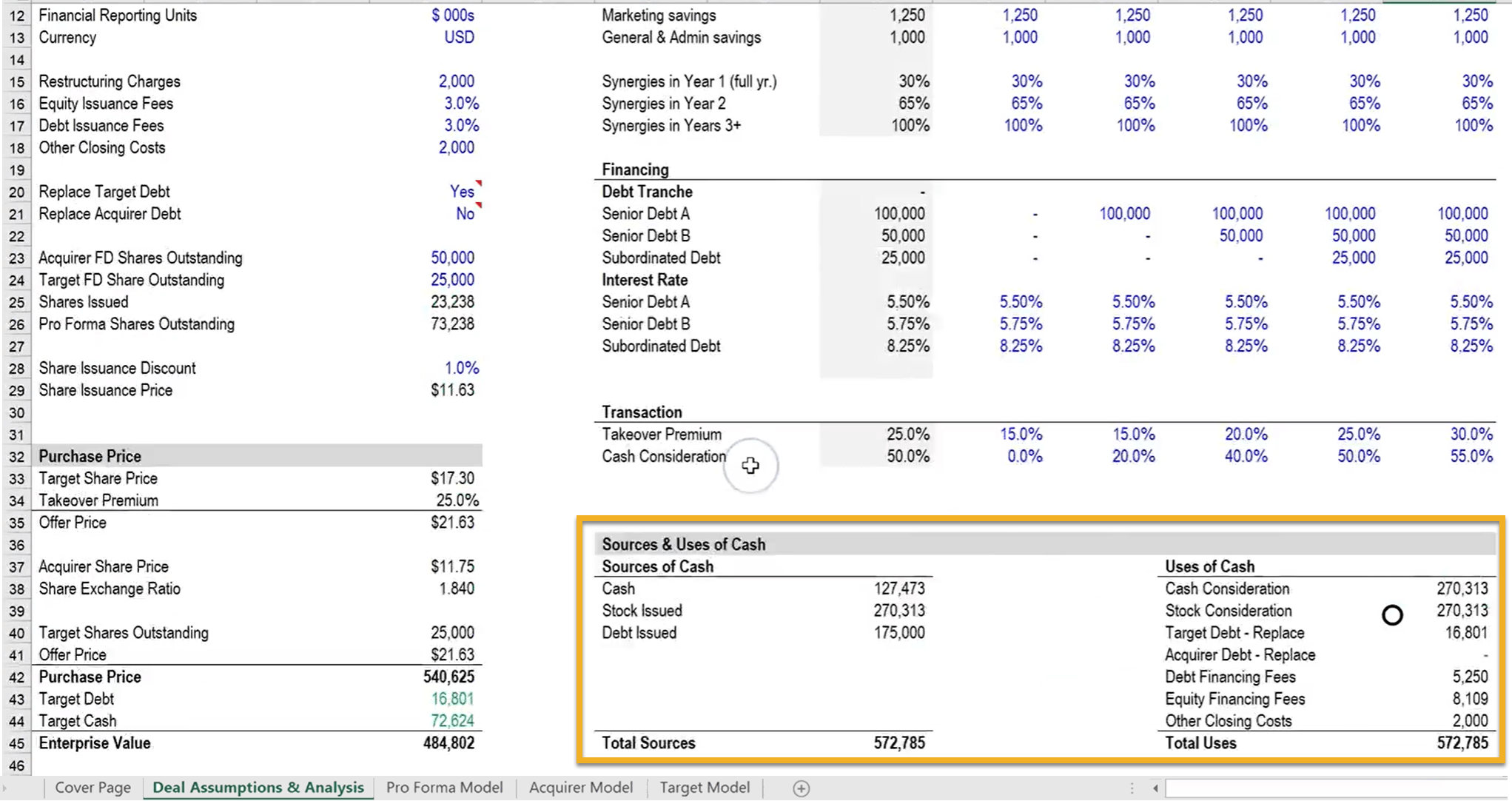

Sources And Uses Of Funds Table Lbo Financing Structure

Sources And Uses Of Cash How To Build A Sources Uses Table

Statement Of Cash Flows How To Prepare Cash Flow Statements

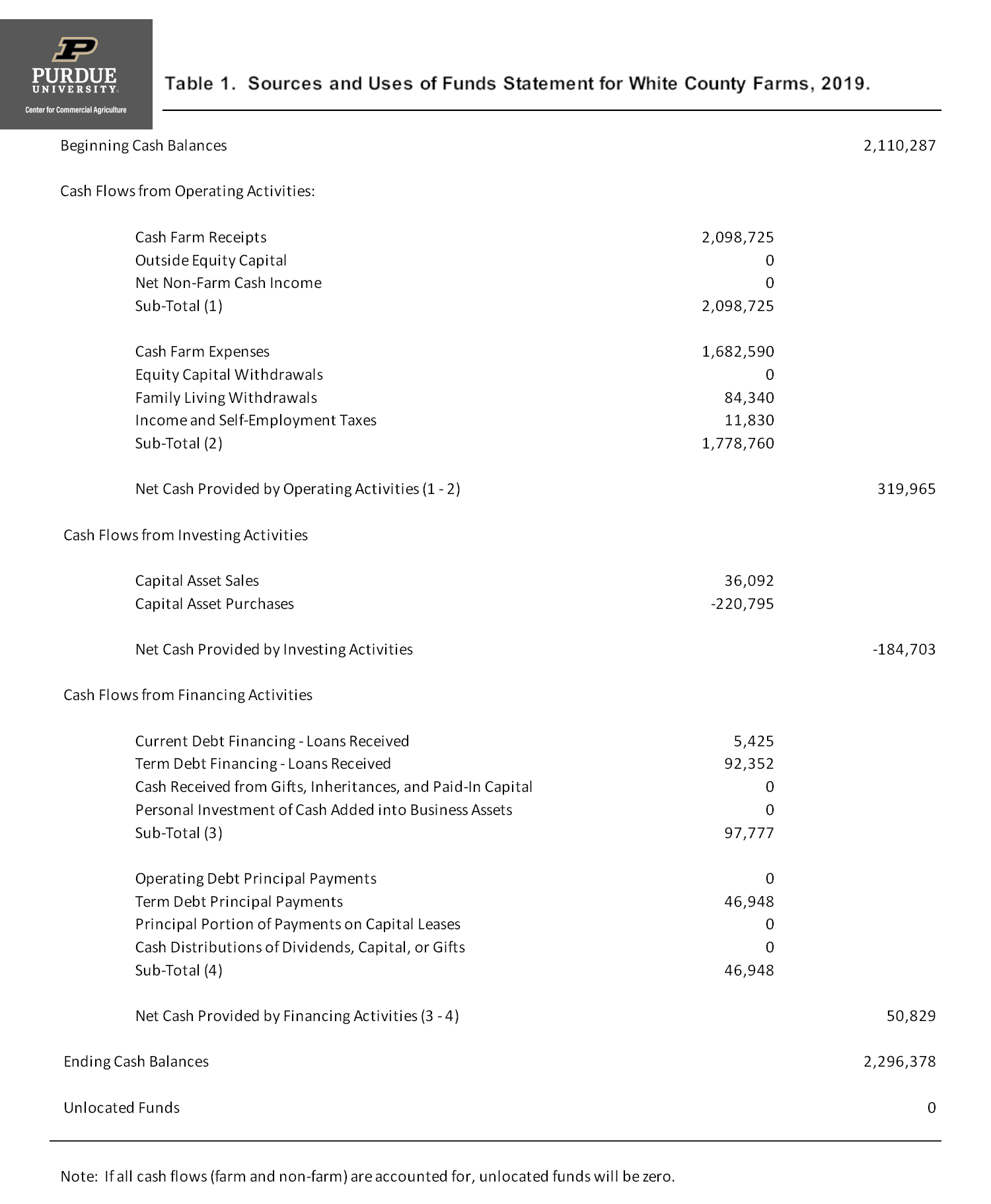

Sources And Uses Of Funds Statement Center For Commercial Agriculture

Private Equity Interview Questions Top 25 Technical Q A

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-02-c8ba3f8b48bc4dc3a460cd7ab6b6c9bd.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities

Sources And Uses Of Cash How To Build A Sources Uses Table

Prepare The Statement Of Cash Flows Using The Indirect Method Principles Of Accounting Volume 1 Financial Accounting

Direct Approach To The Statement Of Cash Flows Principlesofaccounting Com

Prepare The Statement Of Cash Flows Using The Indirect Method Principles Of Accounting Volume 1 Financial Accounting

Comments

Post a Comment